World class coaching & consulting formats for investment management professionals

Why use Panthera Academy?

Do you want to become an Investment Athlete?

Talk to our expert and find out in 15 minutes what is the right solution for you or your team.

Inspiring. Smart. Effective.

Trusted by Clients and Partners Worldwide

Where to start your upskilling experience?

Panthera Elite

Panthera Elite is our premium coaching experience. Available for individuals, teams and corporate levels, we configure a fully customized development plan, designed for performance enhancement. It’s about quality, success and results.

Masterclass & Expert Programme

The Expert programme has been developed for professional investors and organisations that want to help their members achieve excellence in their investment methodologies. Masterclasses delivered in two formats: On-site & virtual.

EXPERT SESSION: This FREE 45mins session demonstrates how to build evidence-based best practices into your daily routine. Book your session now.

Net-Zero Portfolio Management

Sustainable Investing beyond simple compliance – the right ESG strategy will supercharge your Investment Impact. See all out offerings

Public Training Offerings

Bootcamps

NET-ZERO PORTFOLIO

MANAGEMENT

The Bootcamp on Net-Zero Portfolio Management provides intensive training over 4 days, to configure a tailored roadmap for turning portfolios into net-zero carbon emissions. Participants will be introduced to best practices on configuration and management techniques, which are applied to their own case and tested through a competition based-simulation at the end.

Mag. Dr. Markus Schuller, MBA, MScFE / Jonas Englund MBA

Category: Sustainability

Course available on request

STRATEGIC

ASSET ALLOCATION

Strategic Asset Allocation requires an adaptive investment process and this bootcamp delivers exactly that. We introduce practical ‘third generation’ portfolio construction principles to adaptively manage multi-asset & multi-factor portfolios. Participants will reason their case for their own investement-philosophy; -hypotheses; -strategy and -principles. All derived from using the global capital stock as starting point for their strategic asset allocation.

Mag. Dr. Markus Schuller, MBA, MScFE

Category: Human Intelligence

Course available upon request

INVESTMENT

COMMITTEE BOOTCAMP

The Investment Committee Bootcamp is a dynamic 4-day training camp for configuring high performance investment committees. Participants will be introduced to best practices on configuration and collaboration techniques, which are applied to their own case and tested through a competition based-simulation of an investment commitee at the end.

Mag. Dr. Markus Schuller, MBA, MScFE

Category: Human Intelligence

Course available on request

INVESTMENT

ATHLETE BOOTCAMP

Spread over four days, The Investment Athlete Bootcamp provides intensive training for designing a behaviorally optimized investment process. Participants will work on configuring an effective environment in order to make the most rational investment decisions.

Mag. Dr. Markus Schuller, MBA, MScFE

Category: Human Intelligence

Course available on request

Hackathons

INVESTMENT IDEA

HACKATHON

Mag. Dr. Markus Schuller, MBA, MScFE

Category: Human Intelligence

Course available upon request

INVESTMENT AUTOMATION

HACKATHON

Mag. Dr. Markus Schuller, MBA, MScFE

Category: Artificial Intelligence

Course available upon request

INVESTMENT PRODUCT

HACKATHON

Mag. Dr. Markus Schuller, MBA, MScFE

Category: Human Intelligence

Course available upon request

Training Sprints

Human Intelligence

Measuring cognitive diversity in investment teams

Learn how to measure and interpret cognitive diversity among investment professionals.

MORE INFODesign principles for investment committees

Learn how to configure a committee that produces the most evidence-based investment decisions.

MORE INFOGrowth mindset for investors

Understand how to form a narrative based on evidence that supports your investment hypothesis.

MORE INFOStorytelling in investment management

Understand how to form a narrative based on evidence that supports your investment hypothesis.

MORE INFOStrategic business development principles in finance

Learn the reasons why clients decide to work with you or not and leverage them to attract new clients.

MORE INFOStrategic networking principles for investors

Learn how to improve your decision quality as an investment professional by building your most effective professional networks.

MORE INFOBehaviorally optimized risk management

Learn how to apply behavioural design principles in your risk management practice.

MORE INFOBehaviorally optimized strategic asset allocation

Learn how to strategically allocate assets by applying behavioural design principles.

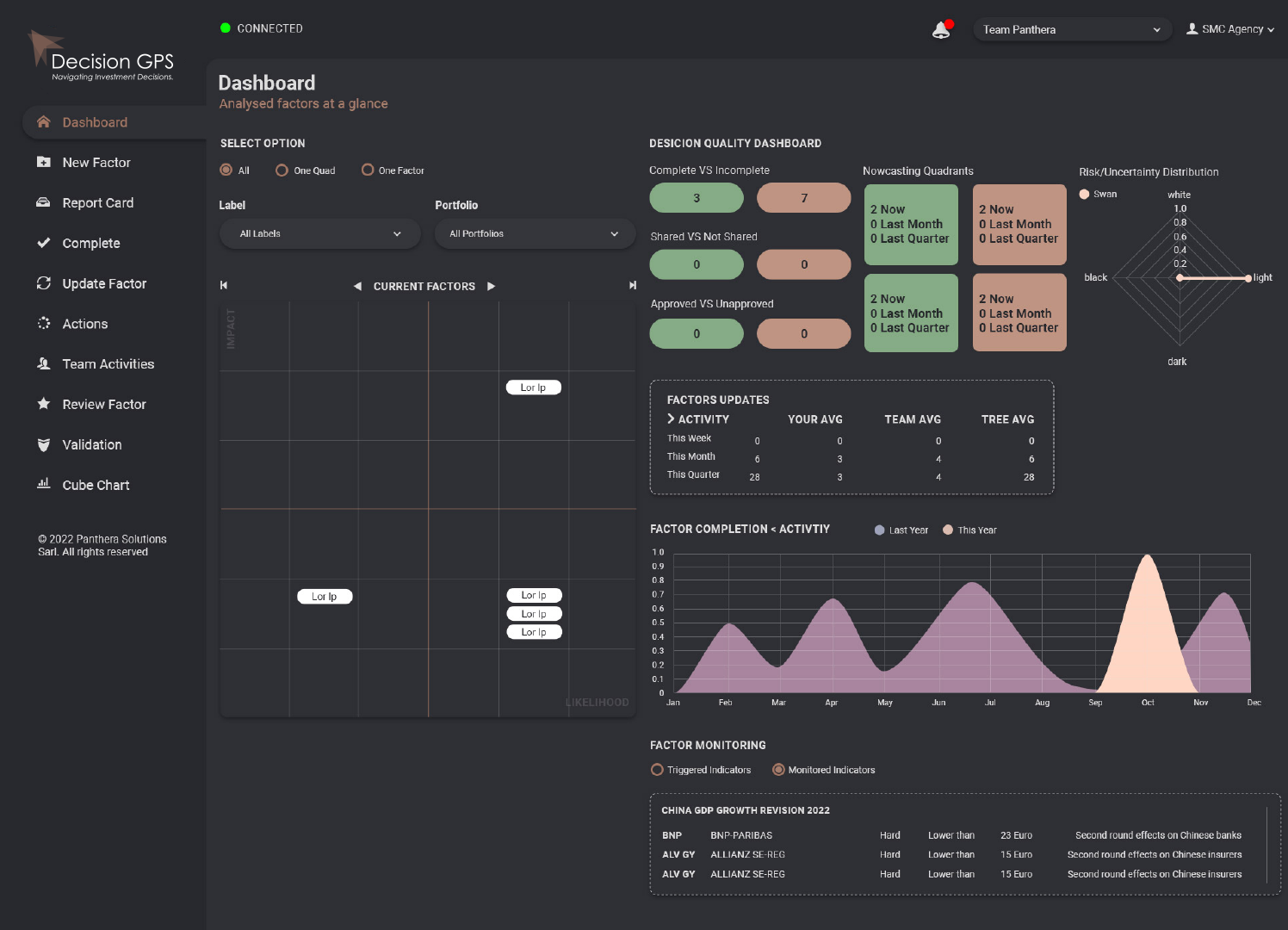

MORE INFOArtificial Intelligence

Advanced portfolio construction

Learn how to get your portfolio construction to best practice levels.

MORE INFOQuantitative alpha generation

Learn how to analyse financial markets by means of econometrics to generate alpha for managing portfolios.

MORE INFOHalf-life of financial knowledge assessment

Learn how to assess the pace at which your relevant financial knowledge deteriorates and how to work against it.

MORE INFONowcasting principles in investment management

Learn how to include latest nowcasting techniques in the investment decision design. Purpose: most rational investment decisions.

MORE INFOCausal inferences in capital markets

Learn how to use causality assessment tools to increase the SDG impact of your investments.

MORE INFOUncertainty management principles

Learn how to configure an optimal environment to make the most rational investment decisions.

MORE INFOSustainable Investing

Co-investing with development finance institutions

Learn about the strategic work of DFIs in relation to Sustainable Finance and how to partner with them as part of your investment strategy.

MORE INFOGreen finance issuer frameworks – best practice

To develop participants’ due diligence skills in analysing Issuers’ Green Financing Frameworks.

MORE INFOSustainability linked bond KPIs and SPTs

To understand the nature of SLB KPIs and SPT and identify risks within these financial instruments.

MORE INFOIntroduction to blended finance in emerging markets

Understand and apply Blended Finance mechanism(s) to an ESG/Climate Finance investment.

MORE INFOIntroduction to social bond investing

Learn how a Social Bond is structured, how to perform Due Diligence and analyse its impact.

MORE INFOESG strategy – SAA implementation principles

To develop a deeper understanding of ESG strategy in relation to SAA implementation.

MORE INFOIntroduction to green bond due diligence

Learn how a Green Bond is structured, how to perform Due Diligence and how to analyse its impact data to your advantage.

MORE INFOIntroduction to green bond structuring

Learn how to structure a Green Bond, perform Due Diligence & broaden your Investor Base by providing visibility through harmonization of Impact data.

MORE INFONet zero roadmap investment design principles

Participants will learn about investment design principles to optimize their net zero roadmap.

MORE INFONet zero mindset making money to make a difference

Participants learn about the net zero mindset needed to successfully master the transition to a low-carbon economy.

MORE INFO